Brexit “British Exit” ?

On June 23, 2016, referendum whereby British citizens voted to exit from the European Union (EU). The action to exit from European Union of Britain or British called as Brexit or British Exit. David Cameron, former Prime Minister of Britain was not in support of Brexit. The exit from European Union will have global consequences over Britain like just after the referendum Pound fall down to its lowest level in decades.

Prime Minister David Cameron resigned on July 13 and Home Secretary Theresa May, leader of the Conservative Party, became Prime Minister of Britain.

Reason of Brexit

Brexit from the supporters point of view is British businesses is being affected by the European Debt Crisis. Greece was the ultimate example of the crisis. The debt over Greece increases which all the country in the European Union have to face. Secondly, immigration from the country which are struggling in for their survival or economic instability. Brexit supporters also argued that Brussels’ bureaucracy is a drag on the British economy and that European Union laws and regulations threaten British sovereignty.

Britain had already opted out of the European Union’s monetary union – meaning that it uses the pound instead of the euro – and the Schengen Area, meaning that it does not share open borders with a number of other European nations.

On seeing the concern at one place it sounds good but if it the case then why Britain were part of European Union in first place.

Consequences seen after referendum for Brexit

Economists of country believe exit from European Union may cause mild recession in 2017. If one laymen on review the purpose of European Union was to have free trade policy with one currency that is acceptable among the countries in EU.

Sarah Ketterer, manager of the Causeway International Value fund, agreed that “from an investment perspective, everything is delayed.” As a result, she said she was “making very conservative assumptions” about conditions in Britain, and she predicted a mild recession in 2017.

She is not alone, and Britain may not be, either, when it comes to the consequences of Brexit. The British bank Barclays warned that Brexit is likely to create substantial headwinds for economies in Britain and on the Continent in coming months.

EU help in raising employments, trades, opportunities and as a single entity or on exit Britain may have to face the isolation from the countries of EU. And we started to see.

EU Council President Donald Tusk says the UK can have either a “hard Brexit, or no Brexit at all”.

Tusk dismissed the idea “that the UK might manage to keep trade benefits of EU membership while barring European immigrants and rejecting EU courts’ authority”, the BBC reports.

It was an “illusion that one can have the EU cake and eat it too”, he said during a speech in Brussels, referencing a claim made by Johnson last month. “I propose a simple experiment: buy a cake, eat it and see if it is still there on the plate.”

Both the UK and the rest of the European Union would end up worse off, he said. There would be “no cakes on the table for anyone. There will be only salt and vinegar”.

Tusk suggested Britain think again about Brexit. “In the future,” he said, “if we have a chance to reverse this negative process, we will find allies, I have no doubt.”

Britain Expectations After Brexit

THERESA MAY, Britain’s prime minister,after Brexit, she wanted a deal that gave British companies the maximum freedom to trade with and operate in the EU’s single market. But at the same time she insisted that after Brexit Britain would become a fully independent, sovereign country that was able to make its own decisions on issues ranging from how to label its food to the way it chose to control immigration. And she said that Britain could not leave the EU only to find itself still subject to the European Court of Justice.

The problem with this is that these goals seem to be incompatible with each other. If Britain wants to benefit fully from the single market, which eliminates all tariff and most non-tariff barriers as well as customs controls, it will have to abide by most European laws, including the free movement of people from other EU countries and a huge clutch of single-market regulations that are ultimately enforced by the European Court. That is what countries like Norway and Switzerland, which are outside the EU but largely inside the single market, have to do; they also pay into the EU budget. Were Britain to choose a similar path, this would amount to a “soft” Brexit that kept many of the advantages of EU membership but at the price of some significant constraints on its independent policy freedom.

The alternative “hard Brexit” would put Britain in a position more like third countries such as America. The Americans are not subject to free movement of people from other EU countries or to all the EU’s single-market regulations, and nor do they make any payments into its budget. But that means they are also not part of the single market, which makes their exports into it subject to both tariffs and non-tariff barriers. Because the EU accounts for 44% of Britain’s exports, including its crucially important financial-services exports, any such barriers would substantially raise the costs that Brexit will impose on the British economy.

The reaction of Donald Tusk on the “soft Brexit” sounds very hard.

Brexit is almost confirm and Theres May is triggers Article 50 – which begins the formal process of leaving the EU. But Senior Ministers believe negotiations after Article 50 may not be completed by 2019 because they are “very complicated and this has never been tried”..

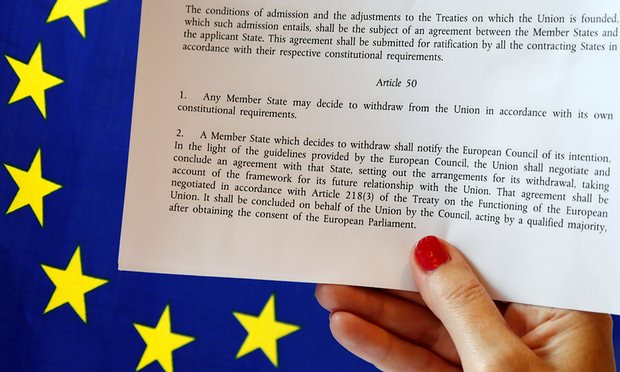

What is article 50 and why is it so central to the Brexit debate?

It’s only 250 words long but has instantly become the defining clause in a war of words between Britain and the EU

Article 50 says: “Any member state may decide to withdraw from the union in accordance with its own constitutional requirements.”

In case of Article 50 and there will be Brexit then there are the country Italy and France also may find a way of negotiation to exit from EU.

Italian Politics

At the forefront of Italexit is the Five Star Movement, started in 2009. The Five Star Movement is the second most popular party in Italy, behind the Democratic Party, which is led by Prime Minister Matteo Renzi. The Five Star movement was already gaining steam prior to Brexit, as the party experienced success in local elections, electing Virginia Raggi and Chiara Appendino as mayors of Rome and Turin, respectively. While the turnout was relatively low, the vote serves as an indication of the state of Italian politics. The forward motion of the Five Star Movement will likely hinge on the success of Brexit in the United Kingdom.

French Politics

In France, there are two opposing political parties. The current French president, François Hollande, falls in line with mainstream French politics and is in favor of France remaining in the European Union. Marine Le Pen leads the Front National, a far-right party, that is in favor of France leaving the European Union. Le Pen, who is running for president against Hollande in 2017, has suggested that France could follow Britain’s lead in leaving the European Union, and that this is the beginning of a movement. She is now pushing harder than ever to start a French movement. Although Le Pen is not expected to win the race, she is expected to reach the final round of the runoff, and Frexit is expected to be a major issue

Brexit Cause Bristish Pound Crash

Fulfilling various negative predictions, the leave vote severely impacted markets worldwide. The British pound crashed by more than 11% against the dollar – its biggest-ever one-day fall – and London’s FTSE and Stoxx Europe 600 fell by 8% on the news. Both Barclays and Lloyds Banking Group saw their shares plummet more than 30 percent before rebounding slightly. Germany’s Deutsche Bank was down about 14%, the Bank of Ireland and two of Italy’s largest banks were all down by more than 20%. Shares in Greece’s big banks were down around 30%.

In the U.S., stock markets were down 3% across the board, with investors rushing to safe-haven assets such as bonds, gold and the Japanese yen. Morgan Stanley and Citigroup were down nearly 10%, with Bank of America, JPMorgan Chase and Goldman Sachs all trading down by between 5% and 7%. Oil prices also trended downwards by 5.2%. In a CNBC interview, former Federal Reserve Chairman Alan Greenspan said the fallout was worse than 1987, calling it the “worst period I recall since I’ve been in public service. The global economy is in real serious trouble. This has a corrosive effect that will not go away,” he added.

The effect exacerbated friction among EU members that has been ongoing since the inception of the euro currency. Many participants in the common currency have long voiced concerns about the value of the euro being tied to the German economy and smaller, slowing economies are struggling from a currency that is artificially high. “I always thought we’re going to start with the euro because the euro is a very serious problem in that the southern part of the euro zone is being funded by the northern part,” Greenspan said on CNBC.

Conclusion Over Brexit in Long Term

The pound could continue to take a pounding. If Britain can no longer rely on continental Europe for barrier-free trade and mobility, there is a strong chance that capital will leave the country to avoid getting stuck there. In other words, investors may sell pounds (or pound-denominated assets) to purchase those denominated in dollars, euros, or francs. A sharp fall could last for longer than anticipated as politicians and deal makers try to establish new trade agreements and economic pacts that can take many months or even years to ratify.Furthermore, if the domestic economy of the U.K. does slip into recession, it will keep the Bank of England (BoE) from raising interest rates to protect the currency, further compounding the problem.