November 8th, 2016 has already marked in the Indian history for the decision made by the Indian Government. Now 31st December had passed and Finance Minister of India presented Budget 2017-18 on 1st February 2017 which is one month ahead of budget presentation as per the tradition.

The backdrop to the Budget was a fairly volatile past few months with multiple issues such as;

- Demonetisation

- Ambiguities On Indirect Transfer Taxes

- Treaty Changes to India-Mauritius Treaty (Mauritius Treaty)

- India-Singapore Treaty (Singapore Treaty)

- India-Cyprus Treaty (Cyprus Treaty)

- Application of General Anti-Avoidance Rules (GAAR)

All of the above concern were on top of the investors’ minds. Given the context, the Finance Minister has managed to maintain a balance between addressing concerns raised by foreign investors along with introducing further rationalization and anti-abuse provisions as part of the Budget.

Tax rates, are reduced by 25% for the company which turnover is less than 50 crores. Foreign investors who were worried about changes to capital gains tax provisions can heave a sigh of relief because there is no change in the provisions, whereas, the Budget has introduced provisions treating conversion of preference share into equity as a tax neutral transaction. This, coupled with the relief for converted shares under GAAR will act as a succor for the private equity industry, all of whom have been grappling with issues relating to conversion of preference shares in light of the GAAR provisions and falling away of various treaty benefits. The one expectation which is hoped to close the loop on this issue is a clarification that the grandfathering provisions in respect of capital gains under the tax treaties (Singapore / Mauritius) apply even when preference shares are converted to equity shares.

Similarly, foreign investors focused on debt markets also enjoy an extension in reduced withholding taxes on coupon payments on rupee denominated debt instruments till 2020. The provisions relating to a reduced 5% tax on interest on masala bonds (rupee denominated) issued before July 1, 2020, which were announced last year have made their way into the Finance Bill, 2017 (“Finance Bill“) along with extension of the benefit of 5% withholding tax on interest paid on Non-Convertible Debentures (“NCD“) to Foreign Portfolio Investors (“FPI“). With a view to increase depth in the bond market, the transfer of rupee-denominated bonds from one non-resident to another has also been exempted.

The Budget has exempted investors (direct / indirect) in category I (sovereign funds) and category II (broad-based funds) FPIs from the application of the indirect transfer tax provisions. This move will hopefully address the significant concern that had been raised by FPIs in respect of multiple layers on taxation and also the potential retroactive application. This exemption must be extended to Category III (other than broad-based) FPIs too. The FM has also announced that offshore redemptions / buybacks of shares of foreign companies, consequent to sale of an investment in India, which could have triggered an inadvertent application of indirect transfer tax will also be exempted, though the same has not yet come through in the fine print of the Finance Bill. It is hoped that this anomaly is addressed soon since this is of significant importance to the PE / VC industry and corporates. However, concerns continue to linger on various other aspects of the application of the indirect transfer tax provisions such as offshore mergers and reorganizations, disclosure and reporting requirements.

Startups,relating to the rationalization of carry forward of losses for start-ups which allow for relaxed conditions with respect to ownership changes have been introduced. Alongside the same, the Budget has also proposed that the three year tax holiday period can be claimed out of a longer block of seven years, which will actually make the tax holiday useful. However, the start-ups’ concerns over potential litigation involving

- investment in start-ups being taxed as income from undisclosed sources; and

- taxation of issuance / transfer of shares at less than Fair Market Value (“FMV“), for genuine commercial reasons have not been addressed.

One other issue which has been seriously affecting start-ups is the imposition of the Equalization Levy (‘EL“) last year. The EL has been imposed in a manner such that it does not fall into the definition of ‘income tax’ or service tax/Goods and Service Tax (“GST“). Hence, tax credits are not available under either Double Tax Avoidance Agreements (“Tax Treaty“) or under domestic service tax laws. Further, considering that the combined impact of GST and the EL could range between 25%-38%, it is disappointing to hear Finance Ministry officials stating that it could be expanded to include more online services this year.

The introduction of thin capitalization rules will definitely raise an area of concern for foreign investors who are investing into India. The thin capitalization rules are a fall out of the Base Erosion and Profit Shifting (“BEPS“) Action Plan and provides for disallowance of interest paid to associated enterprises, if it exceeds 30% of the EBIDTA of the company in any given year. While there are provisions relating to carry forward of the disallowed excess interest, this move will pose a challenge for debt investment into infrastructure and real estate companies, where NCDs and debt push down structures are very common. Linking interest disallowance to EBDITA will also pose a problem for these companies where the industry itself is cyclical in nature.

The introduction of GAAR from April 1, 2017 will also be looked at with trepidation by foreign investors. While checks and balances have been put in place to avoid abuse of the rules by tax authorities, its application in practice will be closely watched. Coupled with the changes that will be brought about with the adoption of the Multilateral Instrument recently released by the OECD as part of its project on BEPS (“MLI“), which inter aliaseeks to put in place business purpose tests for denial of treaty benefits, this will be an area which foreign investors will continue to be concerned about.

The Budget also announced multiple changes in the regulatory landscape, including the proposal for abolition of the Foreign Investment Promotion Board (“FIPB“), which acts as a nodal authority for granting approvals for regulated sectors. This decision has been made in light of the fact that most sectors have been liberalized for foreign investment. Importantly, the Budget has also announced that listing and trading of security receipts issued by a securitization or reconstruction company under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (“SARFAESI Act“) will soon be permitted. This will potentially act towards increasing the depth of the market for security receipts and enhance capital flows in this space. Similarly, the category of persons who qualify as Qualified Institutional Buyers (“QIBs“) for participation in initial public offerings (“IPOs“) will be expanded to include systematically important Non-Banking Financial Companies (“NBFCs“) with prescribed net worth in order to strengthen the IPO market.

The Budget has made significant progress in terms of resolving and ironing out some of the lingering concerns that have been raised by foreign investors. This has been a progressive Budget which has sought to allay fears raised in the recent past on government inaction on issues and has tried to balance that with counter-measures for preventing tax abuse.

1. Regulatory Policy Changes

a) Abolition of the Foreign Investment Promotion Board

The Government has decided to abolish the FIPB in the year 2017-18. This is in line with the comments of the Secretary to the Department of Economic Affairs last year, and the Government’s ushering steps to further ‘ease of doing business’. The FM, in his Budget Speech, however, added that a road map for the abolition would be introduced over the next few months.

The following instances depict the diminishing role of the FIPB over the last few years:

- Increasing liberalization of foreign investments: Since 2015, a large number of sectors, which were hitherto regulated, such as such defense sector, construction-development sector, broadcasting industry, e-commerce, retail, private security agencies etc. have now been liberalized. Inter alia, recognizing that regulators in some sectors (such as asset reconstruction companies and certain financial sector entities) already have a robust mechanism for checks on the incoming investors, the requirement for an FIPB approval has been done away with.

- Approving authority: The Government has been keen on handing over the responsibility of granting approvals to relevant sectoral regulators, instead of the FIPB. This has been seen in the insurance sector, where only the approval of the Insurance Regulatory and Development Authority of India is now required for foreign investment (2016) and in the defence sector, where only the approval of the Ministry of Defence is now required (2016) and in more recent times in the financial services sector.

While the move in isolation may be considered a positive move, it seems unlikely that the Government would abolish the FIPB without ensuring that sufficient checks and balances are in place for sectors in which foreign investment is currently regulated. For instance, it is unlikely that foreign investment in unregulated activities in the financial sector, or brownfield investment in pharmaceutical sector will be permitted without any conditions / approval requirements. The ‘road map’ to be introduced by the Government in this regard, should provide details on how these sensitive issues will be dealt with. This move by the Government should also to some extent, address the conundrum of multiple regulators.

While the move to abolish FIPB is aimed to promote increasing India’s ‘ease of doing business’, it is unlikely that the move will elicit substantial cheer from investors until further details are spelt out.

b) FDI relaxation expected

The FM also mentioned that further relaxation of the foreign direct investment (“FDI“) regime is under consideration and may be introduced shortly. While no indication as to the substance of the relaxations was provided by the FM, the Government has, prior to the Budget Speech, invited comments from the public with respect to concerns with the extant FDI policy. The market has been expecting relaxations in the e-commerce, commercial real estate and retail sectors, amongst other reforms.

c) Listing of security receipts

One of the major changes proposed in the Budget Speech is permitting the listing of Security Receipts (“SR“) issued by Asset Reconstruction Companies (“ARC“) on stock exchanges. The current regulations restrict the issuance of SRs substantially, including that SRs can only be acquired by qualified buyers, SRs should be issued by schemes of the ARC, etc.). Further, none of the stock exchanges permitted listing of SRs, and even the Securities and Exchange Board of India (“SEBI“) (Listing Obligations and Disclosure Requirements) Regulations, 2015 and the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 do not cover listing of SRs.

Currently, only qualified buyers (largely being financial institutions, insurance companies, FIIs / FPIs) are permitted to invest in SRs. Additionally, SRs are illiquid in nature, i.e. there is no ready market available for investor to trade SRs. This has been a major challenge to attract investments into SRs issued by ARCs. While the move to list SRs would be a major fillip to the SR regime, it is left to be seen whether the basket of investors who are permitted to invest in these securities would also be expanded.

The move to permit listing of SRs on recognized stock exchanges, coupled with the changes recently introduced in this sector (i.e. relaxation of individual FPI limits on investments in SRs, and tax relaxations provided last year) promise to provide a big boost for investment in SRs, especially by foreign investors.

d) Payment systems board

As a first step towards overhauling digital payment systems in India and moving towards a cashless economy, the Government has proposed amendments to the Payment and Settlement Systems Act, 2007 (“PSSA“) to constitute a separate board for the regulation and supervision of payment systems under the PSSA, i.e. the ‘Payments Regulatory Board’ (“PRB“). The PRB is to be composed of 6 members, with participation from both the Government and the Reserve Bank of India (“RBI“). This newly constituted board will replace the Board for Regulation and Supervision of Payment and Settlement Systems, which was appointed by the RBI and which currently acts as the supervising authority under the PSSA.

The move seems to be in furtherance of the Watal Committee Report1 which considered the benefits of setting up an external expert (from outside the RBI) to supervise digital payments, given RBI’s bank-centric regulatory priorities. While the recommendation to have an external expert has not been accepted in its recommendatory form, the move to set up a separate committee aims for greater independence of the supervisory authority under the PSSA and consequently allowing for greater reform to payment systems. The FM in his Budget Speech has also announced the constitution of a Committee on Digital Payments by the Department of Economic Affairs which will pioneer the process of bringing in structural reforms to digital payment systems through the year.

e) Categorization of SI-NBFCs as QIBs

In order to ensure participation by sophisticated financial institutions, SEBI, in 2012, made it compulsory for a minimum portion of every book-built IPO floated by companies which do not meet certain basic financial thresholds to be subscribed to by QIBs. The objective behind this change was to lend credibility to IPOs of small companies, and provide signaling benefits to retail investors. Aside from the above, QIBs (especially anchor investors) in general, play a critical role in most of the book-built IPOs, and market trends are largely ascertained based on QIB interest.

Considering the importance of QIB participation in IPOs, the Budget has now aimed to expand the QIB framework. Presently, institutions such as banks, category I and category II FPIs, foreign venture capital investors etc. are categorized as QIBs. The budget now proposes to include systemically important NBFC (i.e. NBFCs with asset size more than INR 5 billion (approx. USD 74 million)) having a certain minimum net worth (which has not been clarified) to be categorized as QIBs. Given the substantial growth of NBFCs over the last decade, this move will certainly add more depth to the IPO market and augment further investments through the QIB route.

Further, while the proposed change is only in respect of IPOs, it may be interesting if the aforesaid NBFCs are categorized as QIBs for other modes of issuances as well, considering the pricing and other benefits which QIBs enjoy in a preferential allotment, qualified institutional placements, etc.

2. Corporate income tax: Reduction in rates for small companies

Two years ago, in the Union Budget 2015-16, the FM had proposed the gradual reduction of corporate income tax rates to 25%. Subsequently, the Finance Act, 2016 took initial (albeit small) steps towards this stated objective by lowering the corporate tax rate for a limited number of small companies2. In the Budget Speech, the FM noted that in spite of their pivotal role in the economy, medium and small enterprises pay tax at effectively higher rates than large companies. In order to make medium and small enterprises more viable and to encourage firms to shift to company structure, the Budget has proposed a reduced tax rate of 25% (as opposed to the current rate of 30%) for domestic companies whose total turnover or gross receipt does not exceed INR 500 million (approx. USD 7.4 million).

The aforesaid proposal is expected to affect nearly 96% of companies in India and reinforces the pro-poor, pro-rural tenor of the Budget. It also should come as a welcome move for small and medium enterprises, many of which were adversely affected by demonetization. However, it may also lead to avenues for tax planning / arbitrage. The reduction in corporate tax rates is also in keeping with a similar trend around the world. It is hoped that the Government will carry forward the movement towards lower rates across the board and that soon, all companies will be brought within the fold of reduced tax rates.

3. Indirect Transfers: partial relief but uncertainty still prevails

The indirect transfer tax provisions, a controversial set of provisions brought about in light of the Vodafone3case, expanded the existing source rules for capital gains. The indirect transfer tax provisions essentially provide that where there is a transfer of shares or interest of a foreign company or entity, whose value is derived substantially from assets located in India, in such case, income arising from such transfer can be brought within the Indian tax net. The indirect transfer tax provisions were introduced in the Finance Act, 2012 by way of Explanation 5 to Section 9(1)(i) of the ITA, “clarifying” that an offshore capital asset would be considered to have a situs in India if it substantially derived its value (directly or indirectly) from assets situated in India.

These provisions had unintended consequences, especially for the India-focused offshore funds industry. A circular4 was released by the Central Board of Direct Tax (“CBDT“) late last year which was intended to provide clarity on the circumstances in which the indirect transfer provisions could apply, but ended up creating more confusion and failed to address key industry concerns with regard to potential double and triple taxation, onerous compliance requirements, and lack of tax neutral foreign corporate restructurings. Please click here to see our hotline on the Circular. Owing to these shortcomings and various representations made by FPIs, and Venture Capital (“VC“)/PE investors, the Circular was subsequently kept in abeyance by the CBDT.

In light of this, it was hoped that the Budget would address the various concerns raised, and provide clarity on the impending issues of redemptions, re-organizations and sales at pooling vehicle level.

The Budget proposes to add a new explanation to Section 9(1)(i) which clarifies that the provisions contained therein shall not be applicable to an asset or capital asset that is held directly/ indirectly by way of investment in a category I or category II FPI. This resolves concerns for a class of offshore funds which are registered as a category I or category II FPIs as redemptions by investors at the level of the fund shall not be subject to the indirect transfer taxation. Further, in multi-tiered structures, if the entity investing into India is a category I or category II FPI, any upstreaming of proceeds by way of redemption / buyback will not be brought within the Indian tax net. The provisions also exclude, from applicability of the indirect transfer tax provisions, situations where any redemptions or re-organizations or sales result in capital gains by investors in category I or category II FPIs.

The clarificatory explanations are applicable retrospectively from FY starting April 1, 2012, and therefore should help bring about certainty on past transactions that have been entered into by category I and category II FPI entities.

However, the amendment has left out a large chunk of the affected sector i.e. category III FPIs, PE and VC investors investing in Indian securities. While the Budget Speech indicated that redemptions of shares or interests of any foreign company, having underlying Indian investments, as a result of or arising out of the redemption / sale of Indian securities which are chargeable to Indian taxes would be exempt from the applicability of the indirect transfer tax provisions, the fine print of the Finance Bill does not provide any such exemption. The Budget also has not clarified on situations relating to offshore mergers, demergers or re-organization of foreign companies which result in the indirect transfer tax being triggered. This can lead to an anomalous situation where a reorganization transaction of foreign companies holding Indian securities are exempt from tax, while re-organization transaction of foreign companies holding other foreign companies, which derive their value substantially from Indian assets are taxable.

Similarly, Section 285A of the ITA read with Rule 114DB of the Income Tax Rules, 1962 (“Rules“) requires that if the shares of a foreign company derives its value substantially from shares / assets located in India through an Indian concern, then such Indian concern shall fulfill onerous reporting obligations as have been prescribed. However, in situations where a private equity / venture capital investor has made portfolio investments, it is extremely difficult and onerous for the Indian concerns to comply with the reporting obligations imposed to keep track of which shareholder has a substantial shareholding. This is especially relevant in light of the fact that most fund documents have non-disclosure requirements relating to their limited partners and sharing the same with the portfolio company on an ongoing basis can be a matter of concern.

4. Assuaging foreign investor concerns: Government clarifies tax code for inbound activity

a) Conversion of preference shares to equity shares: bringing in tax neutrality on conversion

The Budget has proposed an amendment to Section 47 of the ITA to exempt gains arising upon the conversion of preference shares into equity shares from capital gains tax. The memorandum explaining the provisions of the Finance Bill (“Memorandum to the Finance Bill“) has also proposed corresponding amendments to Section 2(42A) and Section 49 of the ITA to provide for determination of holding period and cost of acquisition of the equity shares receivable on conversion of the preference shares. The holding period for the resulting equity shares will now include the holding period of the preference shares and the cost of acquisition of the resulting equity shares will be the cost of acquisition of the preference share in relation to which the equity share was acquired by the investor. The amendments are prospective in nature and will come into effect from FY 2017-18.

Given that Compulsorily Convertible Preference Shares (“CCPS“) are often the preferred instrument of choice for venture capital and early stage private equity investors, these amendments give such investors yet another reason to reconsider the most appropriate strategy and timing for conversion of their CCPS into equity shares in respect of their investments in Indian companies. This is especially pertinent in light of the amendments to the Singapore Treaty and the Mauritius Treaty, and the recent clarifications contained in the circular no. 7 issued by the CBDT on January 27, 2017 (“GAAR Circular“).

Earlier, the conversion of preference shares into equity shares was typically regarded as a taxable transfer due to certain judgments from courts, and the gains arising thereupon were subject to capital gains tax in the hands of the investor. The holding period for the resulting equity shares was calculated from the date on which such equity shares were issued i.e., the date of conversion. However, this position was in conflict with Section 55 (2)(b)(v)(e) of the ITA which, instead of providing a step-up in basis for the equity shares received on conversion, provides that the cost of acquisition of shares acquired by a taxpayer upon the conversion of another kind of shares would be the cost of acquisition of the original share which was converted.

In order to avoid the potential double taxation that arises as a result of this ambiguity, investors typically paid tax at the time of sale of equity shares on the full difference between the sale consideration and the cost of acquisition of the preference shares, or alternatively (a) at the time of conversion of the preference shares, paid tax on the difference between the market value of the resulting equity shares and the cost of acquisition of the preference shares and (b) at the time of sale of the resulting equity shares, paid tax on the difference between the consideration received on the sale of the resulting equity shares and the market value of the equity shares at the time of conversion.

Following the amendment to the Mauritius Treaty and Singapore Treaty, one of the exit routes contemplated by investors was converting their preference shares post March 31, 2017 (thereby availing of the grandfathering benefit i.e., exemption from capital gains tax in India in respect of the conversion), followed by an immediate sale of the resulting equity shares at current fair market value resulting no taxable gains on such sale. While the fact that the holding period of the preference shares would now be counted towards the holding period of the resulting equity shares, the amendments to the ITA would now result in the cost of acquisition of the resulting equity shares being the cost of acquisition of the preference shares (with no step-up in basis) making the aforementioned exit option unviable. Investors will accordingly have to rethink their strategies for exit and on the timing of conversion of the CCPS.

From a GAAR perspective, in terms of the clarifications issued by the CBDT in the GAAR Circular, shares issued post March 31, 2017 on the conversion of CCPS acquired prior to April 1, 2017 should be grandfathered under Rule 10U(1)(d) of the Rules, provided that the terms of the conversion were finalized at the time of issuance of the CCPS. The greater concern therefore, remains that in situations where conversion of CCPS takes place post March 31, 2017 the benefit of the grandfathering provisions under the India-Mauritius and India-Singapore tax treaties may not be available.

b) Fillip for Debt Investments: Continued tax withholding benefits for foreign lenders and introduction of capital gains exemption

In its attempt to incentivize access to foreign capital, the government had introduced a beneficial Tax Deducted at Source (“TDS“) rate of 5% in respect of interest payments made to non-residents. Section 194LC of the ITA viz. the provision concerning the issue covered External Commercial Borrowings (“ECBs“) and long-term bonds (including long-term infrastructure bonds). Prior to the introduction of this regime, interest payments could potentially be subjected to a TDS rate of 20%.

The provision was applicable to agreements entered into / bonds issued on or after July 1, 2012 and had a sunset clause stating that the benefits would only be applicable to agreements entered or issuances carried out before July 1, 2017. However, considering the representations made by industry participants, the Budget proposes to amend Section 194LC to extend the term of the interest rate contained in provision to July 1, 2020. This shall be put into effect from FY 2017-18.

In view of the beneficial TDS regime made available in respect of ECBs in Section 194LC, various stakeholders had made representations to amend Section 194LC in order to extend the benefits of Section 194LC to rupee denominated bonds (masala bonds) issued to non-residents. The government had acceded to the request and issued a press release on October 29, 2015 which indicated that the beneficial TDS rate of 5% would be extended to such issuances. In order to give effect to the allowance made through the press release, the Budget proposes to amend Section 194LC to include interest payable to non-residents in respect of rupee denominated bonds (masala bonds). This amendment is proposed to have retrospective effect and shall be deemed to have been effective from April 1, 2016.

Furthermore, the Budget has also augmented the regime for rupee denominated bonds by amending Section 47 of the ITA to provide that transfers of rupee denominated bonds of an Indian company by a non-resident to another non-resident shall not be considered to be a transfer under the ITA. This amendment shall in effect from FY 2017-18.

These changes will be beneficial in respect of increasing masala bond issuances and ECBs raised by Indian companies. Over the last year, there has been an increasing investor interest in subscribing to such bonds and the clarifications and extensions introduced will provide a fillip to new issuances.

Akin to the amendments proposed to Section 194LC, revisions have also been proposed to Section 194LD of the ITA which provides for a beneficial TDS rate of 5% on interest payments made to FPIs and Qualified Foreign Investors in respect of their investments in rupee denominated corporate bonds and government securities. The reduced TDS rate provided for in Section 194LD is currently applicable to interest payments made on or after June 1, 2013 and before July 1, 2017. The Budget proposes to amend Section 194LD to extend the term of the interest rate contained in the provision to interest payments made until July 1, 2020. In the Indian context, issuances of NCDs to FPIs is one of the most common modes of fund raising. The extension provided till 2020 for lower TDS on interest payments will be beneficial to attract incremental investment through this mode.

The extension of sunset clauses in respect of withholding tax benefits under Section 194LC and Section 194LD will enable Indian companies to continue accessing foreign capital with greater ease. Further, the amendments in respect of issuance of rupee denominated bonds to non-residents and their transferability among non-residents are an effective step towards rationalizing the regime for provision of foreign capital to Indian concerns.

c) Tax neutral demerger: Clarification on cost of acquisition for recipients of capital assets

Continuing in its vein of rationalizing the tax code, The Budget proposes a consequential amendment in respect of cost of acquisition for foreign companies that acquire shares out of a tax neutral demerger under ITA. Such demergers are covered under Section 47(vic) of the ITA which exempts transfers of shares of an Indian company is a demerger process if:-

- The shareholders holding not less than three-fourths in value of the demerged foreign company continue to remain shareholders of the resulting foreign company; and

- Such transfer does not attract capital gains tax in the country in which demerged foreign company is incorporated.

In the aforementioned scenario, the Budget provides that in such cases the cost of acquisition of shares which are consequently transferred to the resulting foreign company shall be the same as it was for the previous owner of the shares i.e. the demerged foreign company. The amendment brings the treatment of cost of acquisition in line with the treatment of the demerger by clarifying on the continuity of cost of acquisition due to the tax neutral nature of the arrangement. The amendment is prospective in nature and is proposed to come into effect from FY 2017-18.

d) Transfer of unlisted securities by non-resident: Government resolves the uncertainty surrounding shares of private companies

Through an amendment contained in the Finance Act, 2012, the government had amended Section 112 of the ITA to provide a concessional tax rate of 10% for non-residents in respect of long-term capital gains arising out of transfer of unlisted securities of an Indian company. The Budget Speech acknowledged that the amendment had initially caused ambiguity as to whether it would be applicable to the transfer of shares of a private company. The Finance Act, 2016 contained a clarificatory amendment stating that the benefits of the amendment shall be made available to a company “in which the public are not substantially interested” thereby covering private companies.

However, this amendment was brought into effect from April 1, 2016 and there was uncertainty around the availability of concessional tax rate for transfer of shares of a private company in the intervening period i.e. from April 1, 2012 to April 1, 2016. With a view to provide clarifications in this regard, the Budget proposed to amend the ITA to clarify that the effective date of the amendment to Section 112 which was brought about in 2016 shall be April 1, 2012 as opposed to April 1, 2016. The amendment shall help assuage the tax payer regarding the uncertainty that existed in respect of transfers of shares of private companies carried out between 2012 and 2016.

5. Ineffective Proposals for the Fund Industry: Half-baked measures continue to plague tax policy

a) Safe harbour for offshore fund managers continues to be ineffective

Section 9A of the ITA seeks to establish a specific regime to promote fund management activity in India. The provision lays down certain conditions upon fulfillment of which, the fund management activity would not constitute business connection in India and an offshore fund would not be resident in India merely because the fund manager was based in India. These conditions relate to, inter alia, residence of the fund, corpus and investor broad basing.

Since introduction, the fund management industry has been unable to take advantage of the provision as the conditions laid down are practically difficult to satisfy. The government has been proactive in its attempt to amend the provision to facilitate its practical application, however the safe harbour provisions are yet to find traction with the industry.

The Budget proposes to amend Section 9A to do away with the requirement for an offshore fund to consistently maintain a corpus of at least INR 1 billion (approx. USD 14.8 million). This will be applicable in case of a fund that has been wound up during the previous year. While the amendment addresses a practical concern, it is unlikely to be sufficient resolve the practicability concerns surrounding the provision.

Despite this amendment and the earlier efforts of the government, onerous conditions such as the requirement to have a minimum of twenty-five investors and the requirement to charge fee that is not less than the arm’s length price continue to act as roadblocks in the progress of the provision.

Furthermore, regard must also be had to the fact that Section 9A primarily caters to managers of open-ended funds. Private equity and venture capital funds are unlikely to consider using the provision as the minimum investor requirement, the requirement to not invest more than 20% of corpus in one entity and the restriction on “controlling” businesses in India make it impractical for such funds to consider using the safe harbour. This is in fact, a mismatch for the industry as India focused private equity and venture capital funds have a greater need to have management personnel based out of India.

b) Still no pass-through for category-III Alternative Investment Funds (“AIFs”)

Akin to last year, there was an expectation among the industry participants that pass through benefits currently available to category I and II AIFs shall be extended to category III AIFs. However, the Finance Bill does not contain any provisions relating to category-III AIFs. Resultantly, category III AIFs, which are typically set up as private trusts shall continue to be governed by provisions concerning taxation of trusts to tackle the issue of income characterization. While long only funds have some clarity on this aspect in light of the recent clarification by CBDT permitting capital asset treatment for listed shares held for more than 12 months, long-short funds will continue to face uncertainty as their holdings may be susceptible to characterization as business income.

c) Easing up of administrative procedures for FPIs

Among various measures introduced with a view to improve ease of doing business in India, the FM in the Budget Speech announced that a common application form for registration, opening of demat accounts and issue of Permanent Account Number (“PAN“) will be introduced for FPIs. The necessary systems and procedures are proposed to be jointly put in place by the SEBI, RBI and CBDT. The measure shall help streamline India related compliances for FPIs who generally face issues while navigating the multiplicity of administrative requirements that need to be met while accessing Indian portfolio investments.

6. Real Estate Sector: Some Relief Post Demonetization

The government’s move to demonetize high value currency notes on November 8, 2016 led to significant disruption in the real estate sector, which has historically been a cash driven sector in India. The Finance Bill has provided some much needed succor to this sector by proposing to make certain favourable amendments to the ITA.

a) Holding Period of Immovable Property Decreased; Base Year Shifted

Capital gains are classified as long term or short term, based on the period for which the assets were held by the transferor. Long term capital gains are subject to reduced tax rates. Currently, for immovable property to be considered as a long term asset, a holding period of thirty-six (36) months is applicable. With the objective of incentivizing investment in real estate, the Finance Bill proposes to reduce this holding period to twenty-four (24) months and bring it in line with the holding period for unlisted shares. This is certainly an encouraging development for taxpayers with investments in real estate and should give a much needed fillip to the real estate sector by encouraging the mobility of real assets.

Further, the Finance Bill also proposes to amend Section 55 of the ITA to shift the base year for computing the cost of acquisition of property by twenty years (from April 1, 1981 to April 1, 2001) for all classes of assets including immovable property. The tax payer is allowed to use either the actual cost of acquisition or the FMV of the asset as on April 1 of the base year as the cost of acquisition. The proposal will definitely buoy the sentiment of taxpayers engaged in the real estate sector.

b) Special provisions for joint development agreement

An issue that has vexed land owners in the past is the issue of determining the point of accrual of income in case of transfer of land to a real estate developer under a Joint Development Agreement (“JDA“). Due to an ambiguity on this point, divergent views have been taken as to when the transfer of land may be considered complete as against the landowner. This ambiguity stems from the fact that while Section 45 of the ITA provides that capital gains tax arises in the year in which the capital asset is transferred, the definition of “transfer” provided under Section 2(47) of the ITA includes “any transaction involving the allowing of the possession of any immovable property to be taken or retained in part performance of a contract of the nature referred to in section 53A of the Transfer of Property Act, 1882 (4 of 1882)“. This means that any arrangement or transaction where any rights in land/building are handed over in execution of part performance of a contract should also be considered as a transfer for the purpose of levying income tax, even though the legal title in the land/building has not been transferred.

As a result of this ambiguity, it is possible for a tax officer to consider different dates, such as the date of (i) execution of the JDA; (ii) handing over of possession of land to the developer (iii) execution of any general power of attorney entered pursuant to the JDA; or (iv) handover of the land owner’s share post completion of building; etc., as the date of transfer of land/building by the owner.

This lack of clarity led to confusion and hardship for the land owners and has been the subject matter of litigation with different views being express by the courts.5 The Finance Bill has provided relief to land owning individuals and HUFs by proposing to suitably amend the ITA in a manner which specifies that in case of any transfer of land/building by an individual or Hindu Undivided Families (“HUFs“) under a JDA, the liability on the transferor to pay capital gains tax will arise in the year in which the project is completed. The project will be considered to be complete when the certificate of completion for the whole or part of the project is issued by the competent authority. The proposed amendment provides much needed clarity regarding the timing of the taxable event and should contribute towards reducing litigation on this subject.

The proposed amendment also clarifies that the consideration for the transfer of immovable property shall be the value adopted or assessed or assessable by any authority of Government for the purpose of payment of stamp duty in respect of that immovable property (as on date of certificate of completion) along with any monetary compensation which may have been received by the land owner.

However, the benefit of the proposed amendment shall not be available to taxpayers who transfer their share in the project to any other person on or before the date of issue of said certificate of completion. In such a case, the tax liability on capital gains shall be determined under the general provisions of the ITA and shall be brought to tax in the year in which such transfer takes place.

The Finance Bill also proposes to insert a new Section 194-IC with effect from April 1, 2017, which puts an obligation on every person making a payment as part of the consideration under a JDA, to withhold 10% of the sum being paid, either at the time of crediting the amount to the account of the payee or at the time of making actual payment to the payee.

c) One year exemption from taxing notional rental income: Relief for developers

Section 23 of the ITA provides that the annual value of any property shall be the sum for which the property might reasonably be expected to be let out. This Section lays down the manner of determination of annual value of house property and currently requires house owners to pay tax on notional income arising from house property even if no actual income is realized through rent. This leads to an adverse tax impact on real estate developers as they are made to pay tax on notional rental income for houses which are unoccupied even after getting completion certificates.

In another significant relief to these real estate developers, the Finance Bill proposes to amend Section 23 of the ITA to exempt them from having to pay tax on notional rental income from house property which is held as a stock-in-trade (provided that the property in question or any part of it is not let-out for any part of the previous year), for a period of one year from the end of the FY in which the certificate of completion of construction of the property is obtained from the competent authority.

These proposed amendments to the ITA which relate to the real estate sector, if carried out, will take effect from April 1, 2018 and will, accordingly, apply in relation to the AY 2018-19 onwards.

In addition to the tax proposals discussed above, additional changes have been proposed relating to concessional rate of tax on debt investments, which is the preferred mode of investment into the real estate sector. Please refer to Section 4B of this hotline for our analysis on the same.

7. General Anti-Avoidance Rules: It’s here!

GAAR which was introduced in the ITA by Finance Act, 2012 is going to come into effect from April 1, 2017. GAAR confers broad powers on the tax authorities to deny tax benefits (including tax benefits applicable under tax treaties), if the tax benefits arise from arrangements that are ‘impermissible avoidance arrangements’

While there was no mention of GAAR in the Budget Speech or any of the other Budget documents, the CBDT recently released a circular providing clarifications on implementation of GAAR. The circular provides responses to queries raised by various stakeholders in the context of the applicability of GAAR. Please click here for our hotline analysis of the GAAR circular.

However, anxiety still exists over the application of GAAR and it still remains unclear on how the Revenue Authorities will practically implement GAAR. Further, it will also be interesting to see how it inter-plays with the recently released MLI.

8. Thin Capitalization Rules: New challenges and new issues!

The Finance Bill proposes to introduce thin capitalization rules within the ITA to curb companies from enjoying excessive interest deductions, while effectively being akin to an equity investment. This move would have a significant impact on investments into India through the debt route – both in respect of Compulsorily Convertible Debentures (“CCDs“) and NCDs which are widely used methods for funding into India.

The Finance Bill proposes the introduction of Section 94B (“Thin Capitalization Rules“) to provide that where an Indian company or PE of a foreign company makes interest payments (or similar consideration) to its associated enterprise, such interest shall not be deductible at the hands of the Indian company/ PE to the extent of the “Excess Interest“. Excess Interest means an interest amount that exceeds 30% of the Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA“) of the Indian company / PE. In the event the interest payment payable/ paid is less than Excess Interest, the deduction will only be available to the extent of the interest payment payable/ paid.

The provisions are an outcome of the BEPS Action Plan 4 adopted by the OECD which proposed a 10 to 30% of EBITDA range for limit on interest payments in intra group transactions. In line with the BEPS Action Plan, the Thin Capitalization Rules provide for a de minimis threshold, provision for carry forward of the Excess Interest for a period of 8 years and exemptions to banking and insurance companies.

Other key points of the proposal include:

- Associated enterprise: The Thin Capitalization Rules are applicable not only in case of interest payments to ‘associated enterprises’, as defined under the ITA but they also cover third party lenders who provide a loan on the basis of an associated enterprise either providing an explicit or implicit guarantee to such third party lender or depositing or a corresponding amount with the lender. This is to cover situations where indirect deposits / guarantees are made by associated enterprises with financial institutions on the basis of which a loan is provided by the financial institution to the assesse.

- Meaning of Debt: The definition of ‘debt’ is wide and covers any loan, financial instruments, financial lease, financial derivative or any other arrangement giving rise to interest, discount or other financial charges. This could potentially cover debt instruments like masala bonds, NCDs, CCDs, ECBs etc.

- De minimis threshold: Interest payments which are less than INR 10 million (approx. USD 150,000) are exempt from the above requirement (on a per assessment year basis).

- Exception: An exception has been carved out for Indian companies / PE of foreign companies engaged in the banking or insurance business.

- Carry forward of interest deductibles: As a clarification, Section 94B also provides for a carry forward of interest expenditure which is not wholly deductible against income under the head ‘profit or gains arising from business’ to the next assessment year (for eg. In case of a loss making Indian company). The carry forward of interest deductible is available for eight assessment years but cannot exceed the Excess Interest.

While the proposals are in line with the BEPS Action Plan 4, there are significant issues that may arise out of their introduction.

Firstly, though the provisions are aimed at related party debt, and intra-group transactions, the meaning of ‘associated enterprises’ is fairly wide under the ITA. This could potentially cover third party lenders who advance a loan constituting more than 51% of the book value of the total assets of the other enterprise and also a guarantor who guarantees 10% or more of the total borrowings of the other enterprise. For example, in infrastructure / real estate projects, it is not uncommon to see lenders providing a debt:equity cover of 4:1 and even in such circumstances, the thin capitalization rules of interest disallowance will apply. The ideal situation would have been to provide appropriate carve outs to third party lenders / guarantors in entirety.

Second, the interest disallowance is linked to EBITDA of the Company. The challenge in this case is that a number of companies who have significant borrowings are in industries which are cyclical in nature, where the interest on borrowings in regular and periodic in nature. This leads to a situation where purely due to market conditions, the EBITDA of a company may fall or it may not be profitable and in those situations, there is an absolute disallowance of interest that is prescribed. The same situation may also arise in cases where a project is under development and consequently does not generate any significant EBITDA, however, in such cases also, there is a disallowance of the interest deduction.

Third, in case of third party lenders, they are captured within the thin capitalization norms, even if there is an implicit or explicit guarantee to such lender. While it is understandable that an explicit guarantee results in the application of the Thin Capitalization Rules, it is unclear as to what is meant by implicit guarantee and what constitutes implicit guarantee. Questions such as whether comfort letters or similar undertakings, whether legal binding or otherwise, can be treated as an implicit guarantee arise.

Lastly, GAAR which is coming into effect in FY 2017-18 also provides wide powers to the tax authorities to re-characterize debt into equity, and vice versa. The GAAR Circular issued last week does not provide any limitations on the tax authorities’ powers where the transaction is subject to specific anti avoidance rules. This could lead to unintended consequences where the same transaction is subject to GAAR, as well as the Thin Capitalization Rules, and despite not falling foul of the Thin Capitalization Rules, GAAR may still be initiated.

9. Capital gains on transfer of unlisted shares: Tax on notional income, a mis-step!

Under the ITA, capital gains are calculated as the amount by which the full value consideration received exceeds the cost of acquisition of the capital asset. The full value consideration is typically the actual consideration resulting from the transfer, irrespective of whether or not such consideration corresponds to the FMV of the capital asset. Transfers at undervalued consideration are taxed in the hands of the transferee (or acquirer) on the excess of FMV over the consideration amount as ‘income from other sources’ in accordance with Section 56.

The Finance Bill has proposed an amendment whereby in respect of transfers of unlisted shares of a company, at less than the FMV, the FMV would be deemed to be the full value consideration for computing capital gains. This essentially results in increases the capital gains tax burden for the transferor by bringing into the tax net a concept of notional gains which is actually not received by the transferor. While this has seemingly been introduced as anti-abuse provision, and is similar to an existing provision under Section 50C of the ITA which is applicable in respect of immovable property, the challenge lies in the fact that even commercial transactions between unrelated parties can be subject to this notional tax. The other major concern with this provision is that when read with Section 56, it leads to a situation of double taxation since (a) the transferor company is taxed on a notional capital gains on the difference between the notional fair market value of the shares and the actual consideration received; and (b) the transferee company is taxed under Section 56 in respect of the difference between the notional fair market value of the shares and the consideration actually paid. This provision can lead to a lot of hardship, especially in situations such as distress sale or where the business prospects have eroded. In such circumstances, double taxation can lead to a significant concern for the parties to the transaction.

Coupled with the fact that the scope of Section 56 has been further expanded to cover a wide category of persons (explained below), this provision could lead to an undesirable economic double taxation on the notional amount which is the difference between the FMV and the actual consideration.

10. Tax on Acquisitions below FMV expanded: All Acquirers covered

Since 2009 individuals and HUFs have been subject to tax with respect to acquisition or receipt of any asset below FMV (subject to certain exceptions such as receipts from a relative, on the occasion of marriage, etc.). Further, in 2010, unlisted companies (not being a company in which the public are substantially interested) and partnerships (including Limited Liability Partnerships (“LLPs“) were also brought within the scope of this provision and accordingly, subject to taxation on the shortfall in case of acquisition of shares below FMV.

The Budget now proposes to expand the scope of the relevant provisions to cover all persons including inter alia, Association of Persons (“AOPs“), listed companies and foreign persons, with only limited exceptions for charitable organisations, educational institutions, hospitals, etc. Further, the provisions are proposed to be expanded to cover acquisition / receipt of almost all types of assets (and not just shares), with an exception only in limited cases such as marriage, etc., which are already currently excluded in case of individuals.

Partnership interest in LLPs: The list of assets covered include “shares and securities”. The term “securities” is not specifically defined for this purpose. In several provisions of the ITA, the term “securities” has been defined in terms of the definition under the Securities Contracts (Regulation) Act, 1956, which primarily focusses on marketable securities. While partnership interests in an LLP are not marketable securities, in the absence of a specific definition of the term “securities”, it is not clear as to whether the provisions are intended to apply to partnership interest in LLPs.

a) Taxation of contributions made to irrevocable discretionary trusts:

Contributions made to an irrevocable trust are not taxable in the hands of the contributor by virtue of a specific provision. However, in the hands of the transferee, i.e., trustee, particularly, in the context of discretionary trusts, the proposed expansion increases the risk of tax exposure. Before 2009, contributions made into a trust were typically considered capital receipts and therefore, not taxable in the hands of the trustee. Since 2009, when these provisions were introduced, in light of various factors governing taxation of irrevocable discretionary trusts, the issue regarding taxation of trustees with respect to receipt of contributions is far from settled. A trust is only an “obligation annexed to ownership of property”, it is not a “person” and taxation of income of a trust in the hands of a trustee is only in his capacity as a representative assesse (of beneficiaries of the trust). However, for determining what qualifies as ‘income’ in the hands of the trustee of a discretionary trust, determining the status of the trustee for tax purposes becomes important. Some cases have taken the position that the status of a trustee should be that of an “individual” in certain factual situations. Having said that, this is not a settled position. Therefore, with the Finance Bill proposing to expand the provisions to cover all type of “person”, the risk of tax exposure is higher, particularly, where all the beneficiaries may not qualify as “relatives” of the person/(s) contributing assets into the trust.

b) Double taxation:

In case of immovable property and unlisted shares, there will be potential double taxation – i.e., taxation in the hands of the transferor and the transferee. The provisions discussed above deal with taxation in the hands of the transferee, while Section 50C of the ITA (in case of immovable property) and the proposed Section 50CA (in case of unlisted shares), tax the transferor on transfer of such assets at less than the value applicable for stamp duty purposes (in case of immovable property) / FMV (for unlisted shares).

c) Absence of Foreign Tax Credit (“FTC”):

In the context of non-residents acquiring assets in India, most Indian tax treaties do not provide relief from taxation in India on acquisition of Indian assets. In case of such non-residents where treaty relief is not available, non-residents may not be able to claim FTC for such Indian taxes, as taxation in the hands of the acquirer / recipient is unique in an Indian context and corresponding taxes are not levied in other countries (against which FTC can be claimed).

d) Applicability to legitimate transactions:

Provisions relating to taxation of acquisitions below the FMV are an anti-abuse measure, as acknowledged by the government itself in several instances. There are several legitimate transactions without any element of abuse which could get covered within the scope of such provisions. These include situations such as a distress sale or a situation where goodwill or other intangibles which have been capitalised in the books of the company at a certain value and such valuation has gone down over a period of time, or a situation where potential risks and liabilities or regulatory changes have reduced the valuation of a business entity. The FMV of shares of an unlisted company is prescribed in terms of book value of the company. In the examples outlined above, the transfer of such shares may legitimately be undertaken at less than the FMV (i.e., book value). Further, even acquisition / receipt of assets by public companies, which are anyway subject to scrutiny at various levels are subject to these provisions.

Being an anti-avoidance measure, and with GAAR coming into force from April 1, 2017, there have been expectations that these provisions would be limited in their scope of application. For example, in case of acquisitions below FMV, the applicability of the provisions could be limited to circumstances only where taxpayers are unable to provide justification for the difference, etc.

In fact, before the introduction of these provisions, when tax authorities sought to tax such acquisitions / receipts, the courts have not allowed it, considering that such taxation is only on a notional basis. Also, the Report of the Income Tax Simplification Committee headed by Justice R.V. Easwar recommended that such provisions should not be made applicable in case of acquisition of immovable property. In contrast, the Finance Bill has expanded the scope of the provisions to make them applicable to all assets and to all recipients. This is not in line with the government’s constant emphasis on improving the ease of doing business in India.

11. Long Term Capital Gains: Restrictions on exemption for sale of listed shares

The Budget has proposed restrictions on the existing exemption provided under Section 10(38) of the ITA for long term capital gains arising on the sale of Indian listed equity shares on the stock exchange. The ITA currently does not tax long term capital gains earned from such transactions as long as the transactions were entered into after the coming into force of the Securities Transaction Tax (“STT“) and were chargeable to STT.

The Memorandum to the Finance Bill notes that the exemption from tax provided for long term capital gains upon transfer of listed shares, is being misused by persons for declaring unaccounted income as exempt long term capital gains by entering into sham transactions. The Budget has therefore proposed a proviso to Section 10(38) to the effect that the exemption therein will not be available where the acquisition of the equity shares being transferred was not chargeable to STT (in spite of the acquisition taking place after the coming into force of the STT). This could be relevant, for instance, in cases of misuse of inactive listed companies though price manipulation or mergers, preferential allotment etc. The language of the proposed proviso allows for certain carve outs through the mechanism of notifications for genuine cases where the STT was not paid such as IPOs and FPOs.

The proposed amendment is an anti-abuse measure and part of the larger program of the Government for cracking down on black money, a program which has been reflected in various Budget proposals. While the intention of the Government to crack down on black money is appreciated, the approach of providing a proviso in the legislation but leaving carve-outs for such proviso to be introduced through notifications can create uncertainty for taxpayers. Considering that the carve-outs are meant to be created for genuine transactions, the fallout of the approach is that genuine taxpayers will be put to hardship arising from the uncertainty that their relief would be left to the mercy of notifications. The hope is that the notifications in this regard are drafted with extreme clarity and issued at the earliest.

12. Transfer Pricing: Secondary Adjustment Concept Introduced

The Budget has proposed two important changes with respect to transfer pricing under the ITA which will come into effect on April 1, 2018, and will accordingly apply to assessment year 2018-19.

a) International Transaction

The first amendment introduces Section 92CE which requires a resident taxpayer who has entered into an international transaction to make a secondary adjustment in the event that a primary adjustment as per transfer pricing provisions:

- has been made suo moto by the taxpayer in his income tax return,

- has been made by the Assessing Officer and accepted by the taxpayer,

- has been determined by and advanced pricing agreement,

- is made as per safe harbor rules under the ITA,

- is a result of mutual agreement procedure (“MAP“) under a tax treaty

The provisions further prescribe that where, as a result of primary adjustment, there is an increase in the taxpayer’s total income or a reduction in allowable loss, a secondary adjustment shall have to be made. The secondary adjustment is intended to reflect the actual allocation of profits between the taxpayer and the associated enterprise. The purpose of such secondary adjustment is also to eliminate the imbalance between the taxpayer’s accounts and actual profits. The Section prescribes that the excess money (difference between the arm’s length price determined in the primary adjustment and the actual consideration price) shall be deemed to be an advance made by the taxpayer to its associated enterprise, if it is not repatriated to India within a prescribed time. Once deemed to be an advance, interest shall also be payable on the excess income until the obligation to repatriate such amount is discharged. While the rate of interest is to be calculated in a manner prescribed by the government, it should also be determined at an arm’s length price.

However, Section 92CE will not be applicable where the amount of primary adjustment made in any previous year does not exceed INR 10 million (approx. USD 150,000), and is made in respect of an assessment year commencing on or before the April 1, 2016.

Although secondary adjustments are an internationally accepted principle and are in line with OECD’s Transfer Pricing Guidelines, the implementation of Section 92CE may result in various practical difficulties. For example, the foreign country in which the associated enterprise is located may have exchange control provisions that make it difficult to repatriate the excess money to India, or it may have adjusted the transaction as per its own transfer pricing provisions and already taxed a portion of the funds Indian tax authorities consider as excess income. The introduction of these provisions and also those relating to thin capitalization show the increasing tendencies of the government to look at international practices in molding tax legislation in India.

b) Specified Domestic Transaction

The second amendment involves restricting the scope of specified domestic transactions which are subject to transfer pricing by introducing an amendment to Section 92BA of the ITA. Currently, transfer pricing provisions under the ITA are applicable to specified domestic transactions where the aggregate of such transactions in the previous year exceeds INR 200 million (approx. USD 3 million). The condition that transfer pricing will be applied in respect of determining the arm’s length nature of expenditure incurred has now been removed. This is intended to reduce the compliance burden on the following taxpayers who are currently related parties under Section 40A(2)(b).

13. Impact on Startups

The current provisions provide restrictions on carry forward of losses in case of substantial change in shareholders of the Indian company. Essentially, shareholders of the company at the end of the financial year in which the loss was incurred must own at least 51% of the shares in that company in the year that the carry forwarded loss is claimed as a deduction; otherwise, the company loses the ability to carry forward the loss. In the context of start-ups the carry forward of losses becomes crucial. However, start-ups typically experience significant change in shareholding due to multiple investment rounds and are often unable to meet the above conditions for carry forward of losses.

To remedy this, the Budget proposes that as long as all the original shareholders of the Company at the end of the financial year in which the loss was incurred continue to be shareholders in the financial year in which it is claimed, the benefit of carry forward loss will be available. The loss can be carried forward and claimed only if it was incurred within seven years of the incorporation of the company. Hence the change in the current Budget to allow the carry forward of such losses is welcome.

Further, in the previous budget the Government had introduced Section. 80-IAC wherein a start-up could elect to have its income exempt from income tax for three successive years within a block of five years. Many start-ups could not practically avail of these benefits since they were mostly loss making in those years and they were unable to qualify as an ‘eligible start-up’ as well. To make this benefit more meaningful, the Budget appears to have taken into account the fact that start-ups may take a longer period to become profitable and has now made an amendment wherein a start-up could now elect to have its income exempt from income tax for three successive years within a block of seven years instead.

While these measures are laudable, it is disappointing to see other issues that plague start-ups such as exemption from Section 56 (income from other sources) and 68 (income from undisclosed sources) remain unresolved. Exemption from minimum alternate tax (“MAT“) for start-ups would have also been welcome since it would have helped start ups avail of the benefits of the carry forward losses in a meaningful manner. Further, the pain point of the EL, which was introduced last year, still continues and government officials during post Budget interviews have indicated the Government intends to expand it to cover a few more online services. In spite of the above concessions, this along with the GST, which will be implemented in the near future, could have a combined potential tax impact of between 25% to 38% on start-ups focusing on the digital space.

14. MAT

Section 115JB imposes an obligation on companies to pay a MAT of eighteen and a half per cent of its book profit (calculated in accordance with the provisions of the Companies Act, 2013), if the tax otherwise payable on total income is lesser after taking into account other allowable deductions under the ITA. Thus, MAT was intended to be a measure akin to a presumptive tax and an anti-avoidance measure. It has no correlation to actual profits and is impacts genuine businesses in India.

While the ask is to eliminate MAT altogether, the Government has retained these provisions albeit with tweaks. The Government’s has repeatedly expressed the intention to phase out the various exemptions available under the ITA, however, as it may be several years before it can benefit from the phasing out of such exemptions, the Government has decided to not do away with MAT. Instead, to reduce the burden on the companies, the Budget proposes a 15 year carry forward of the MAT credit as opposed to the current 10 years carry forward.

Further, currently it is the difference between the MAT paid and the tax computed under the normal ITA provisions that can be carried forward as credit for future years and be set off against tax payable under normal ITA provisions. However, as per the new provisions proposed in this budget, MAT credit will not be allowed to be carried forward to the extent that the amount of FTC that can be claimed against MAT exceeds the amount of FTC that is claimable against tax computed under the normal ITA provisions.

Further, in light of the implementation of the new Ind-AS, detailed provisions have been proposed to compute MAT in accordance with the revised accounting standards. There are provisions for the first time adoption of MAT as well as for the accounting and MAT treatment in the future years.

15. POEM

Recently, on January 24, 2017, the CBDT issued a circular6 containing what appear to be the final guiding principles (“Revised Guidelines“) to be taken into account during the determination of the POEM of a foreign company. Please click here for out hotline analysis the final guidelines. Earlier under Section 6(3) of the ITA, a foreign company was regarded as a tax resident of India only if it was ‘wholly controlled and managed’ in India. This test of residence was both objective and predictable for the taxpayers. In 2015, the Finance Act amended Section 6(3) of the ITA to provide that a foreign company would be considered to be a tax resident of India if it’s POEM7 was found to be situated in India (the “POEM Test“). The Final Guidelines have been issued with only a couple of months left in the FY for companies to set their affairs in order and, although there has been an attempt to address some of the concerns raised by stakeholders, the uncertainty and subjectivity inherent in the POEM Test remain.

16. Defining ‘terms’ in tax treaties: Right motivation, correct method?

Under the ITA, if India has a tax treaty with a foreign country, then the taxpayer may be taxed either under domestic law provisions or the tax treaty to the extent it is more beneficial. As it is the case with most treaties, all terms used in the treaty may not be defined in the treaty.

In order to mitigate unwanted litigation, the said provisions provide that if a ‘term’ is used in a tax treaty but not defined in the ITA or the tax treaty, it shall have the meaning assigned to it in the notification issued by the Central Government in the Official Gazette in this behalf, provided the same is not inconsistent with the provisions of this Act or the agreement. The ITA further provides for an Explanation which states that when a meaning is assigned to a term by way of a notification as specified above, it shall be retroactively applicable from the date on which the treaty came into force.

The Finance Bill proposes to amend these provisions to add an Explanation which provides that where any ‘term’ used in a tax treaty is defined under the tax treaty it will be given the same meaning as provided in the said tax treaty. However, in a case where no meaning has been assigned to the ‘term’ in the treaty, but the ‘term’ has been defined in the ITA, it shall be assigned the meaning as provided in the ITA or any explanation given to it by the Central Government.

The motive behind the amendment, as provided in the Memorandum to the Finance Bill, is to avoid litigation related to taxation of non-residents as suggested by the income-tax simplification committee on interpreting terms in tax treaties. Further, while the amendment only seems to extend the provisions already provided in the ITA with respect to use of terms not defined, the amendment can be potentially misused. What needs to be understood is that currently under the ITA, for a term not defined under the ITA / tax treaty, a notification will need to be issued by the Central Government which will be notified in the official gazette. The amendment, however, is trying to bypass this procedure by allowing the Central Government to provide meaning to a term simply way of a circular / instruction bypassing the procedure of a formal notification in the Official Gazette. Such an amendment (though correct in spirit) has the potential to be abused to define terms in the tax treaty in a unilateral way without proper procedure being followed.

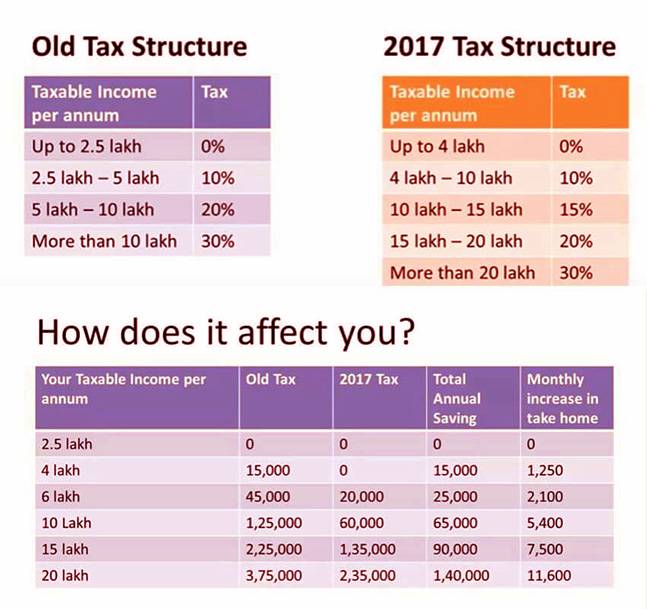

Salaried employee are much more looking for the tax slabs and relaxation in taxes. Not much changes in the slab only the 5% decrease tax rate for the people who are earning more than 3 lacs.

| Annual Income | Income Tax | Education Cess | Higher Education Cess |

| Upto Rs 3 lakh (for senior citizens) | Nil | Nil | Nil |

| Rs 2.5-5 lakh | 5% | 2% | 1% |

| Rs 5-Rs 10 lakh | 20% | 2% | 1% |

| Above Rs 10 lakh | 30% | 2% | 1% |

| Above Rs 50 lakh | 30% | + 10% surcharge | |

| Above Rs 1 crore | 30% | + 15% surcharge |

-

An amendment was proposed to the RBI Act to enable the issuance of electoral bonds for political funding.

-

Political parties will be entitled to receive donations by cheque or in the digital mode from their donors.

-

Maximum cash donation any party can receive will be Rs 2000 from one source.

-

A single one-page form for filing IT returns for taxable income up to 5 lakh rupees.

-

No cash transaction of above Rs 3 lakh will be allowed.

-

Income tax for small companies with an annual turnover of 50 crore has been slashed by 5 per cent to 25 per cent.

-

Capital gains tax to be exempted, for persons holding land from which land was pooled for creation of Andhra Pradesh capital at Amravati.

-

Aadhar-enabled payment system will be launched soon.

-

The lending target of Pradhan Mantri Mudra Yojana has been doubled to Rs 2.44 lakh crore for 2017-18.

-

Total expenditure of Budget 2017-18 has been placed at Rs 21.47 lakh crore.

- In case of small companies, with turnover in the financial year 2014-15 not exceeding INR 50 million (approx. USD 750,000), the Finance Act, 2016 lowered the corporate tax rate to 29%. Further, companies set up on or after March 1, 2016 and engaging solely in the business of manufacture or production, were given the option to be taxed either at the rate of 30% or at the rate of 25% in case they do not claim any profit or incentive linked benefits under the ITA.