Applying for Permanent Account Number (PAN) then you must know that today i.e 9th Sept 2018 the Income Tax Department proposed to do away with the mandatory requirement of mentioning father’s name.

According to a draft notification, where the mother of a PAN applicant is a single parent, the individual would have to mention only the name of the mother.

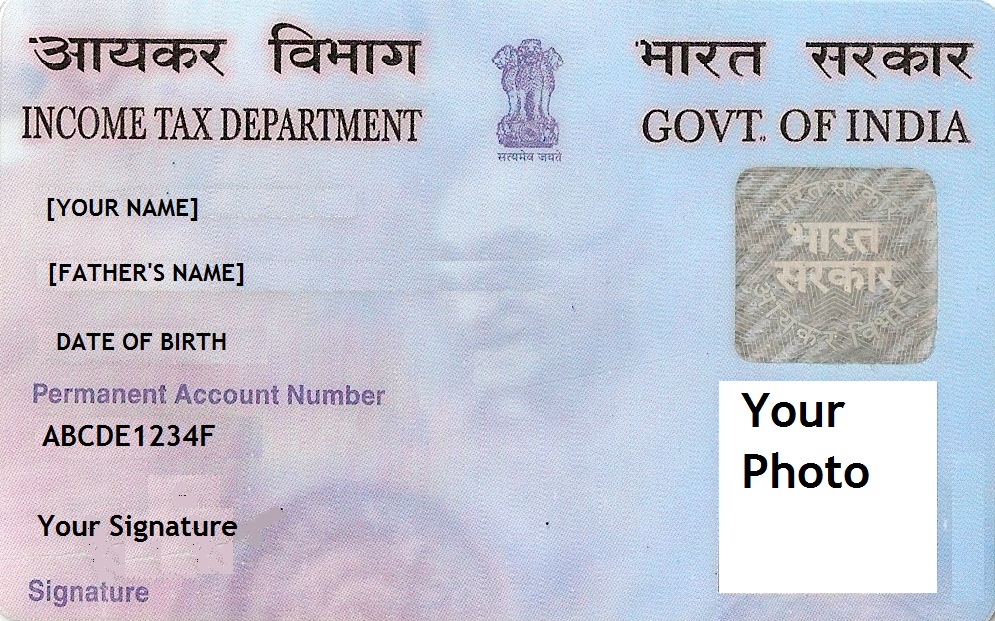

At present, providing father’s name in the PAN application forms (Form No. 49A and Form No. 49AA) is mandatory, however, the applicant has been given an option to select the name of either father or mother, which the applicant may like to be printed on PAN card.

Top Post: Fix Fake Text Messages In WhatsApp : Ravi Shankar Prasad

“In order to provide that father’s name shall not be mandatory in PAN application forms, where the mother is the single parent, an amendment in PAN application forms is proposed to provide that …. Mentioning mother’s name shall be mandatory in cases where father’s name is not furnished and mother is the single parent,” the CBDT said in a draft notification on which it has invited stakeholder comment by September 17.

The tax department is also proposing to empower Principal Director General or Director General Income Tax to specify the manner in which PAN would be issued to an applicant.

Under the current norms, a Permanent Account Number with 10 alphanumeric characters has to be issued in the form of a laminated card.

The draft notification also posses a timeline for applying for PAN card by entities entering into financial transactions of Rs. 2.50 Lakh or more in a financial year.