NEW DELHI: It is going to be a busy travel schedule for ministers in the Narendra Modi government till the …

NEW DELHI: It is going to be a busy travel schedule for ministers in the Narendra Modi government till the …

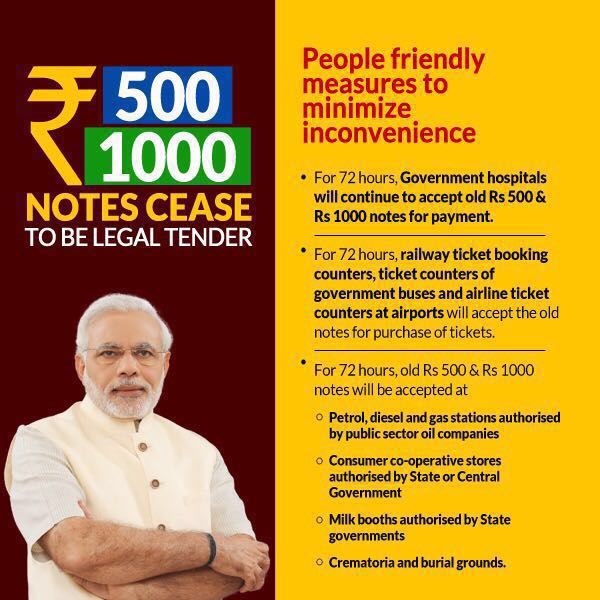

November 8th, 2016 has already marked in the Indian history for the decision made by the Indian Government. Now 31st …

Vijay Mallya is living in London now or we can say, hiding in London. Yesterday after 8 days of demonetisation …

Arun Jaitley says deposits of now-defunct old Rs500, Rs1,000 notes in bank accounts will not enjoy immunity from tax and …

India’s Finance Minister Arun Jaitley said on Sunday he expects lawmakers to make progress on a goods and services tax …

The introduction of Goods and Services Tax (GST) is one of the biggest tax reforms for India. GST is not …

The provisions of Finance Bill, 2016 relating to direct taxes seeks to amend the Income-tax Act, 1961 (‘the Act’) , …

New Delhi: In a first of its kind of exercise to gauge public mood, the Finance Ministry on Wednesday …

Send this to a friend